Food supplements: supporting start-ups on the path to success

The food supplement market has been growing steadily for over ten years and still continues to attract start-ups young brands often born online that hold essential keys to addressing new generations of consumers.

However, the road to success is long and challenging, especially in the highly competitive nutraceutical market. Only about 10% of start-ups manage to reach their sixth year of existence.

To optimise their chances of success, these innovative companies increasingly choose to seek support from advisory structures to enhance their expertise and assist in their strategic decisions.

Start-ups: the new players in food supplements

Cultivating a sense of belonging, innovating and personalising the offer through customer data processing, providing transparency and information – these young dietary supplement brands know how to leverage digital tools to meet the expectations of their communities.

Also known as DNVB (Digital Native Vertical Brands), their uniqueness lies in addressing and selling their products directly to consumers without intermediaries, mainly via their websites and social networks. This model is growing across all sectors: the number of DNVBs in France jumped by 324% between 2021 and 20221. The well-being sector, including food supplements, is experiencing the most rapid growth, with a 52% increase during this period1.

Brands like Cuure, Epycure, Mium Lab, Nutri&Co, Aime, And Dijo exemplify this new dynamic, using online sales to appeal to younger generations. However, digital distribution is not the only specificity of these successful brands.

Reinventing the success codes of food supplements

These brands are also responsible for ultra-personalising the offer (with Cuure leading the way) and the development of “Beauty from within” and in-out solutions (Skin & Out perfectly illustrates this trend with its nutri-cosmetic range dedicated to acne).

The importance placed on the pleasure of use and sensory experience is also very pronounced among these food supplement start-ups (Check out our complete article dedicated to this topic here) 2

Lashilé initiated this shift in 2019 by launching the first gummies, and Nonna Lab aims to improve treatment adherence by offering chocolate pearls enriched with plant actives, which Dorian Barberan, CEO of Nonna Lab, describes as “effective, practical, while providing sensory pleasure.”

These new stakeholders in the nutraceutical landscape proudly showcase their values: trust, transparency, and “impact” (in the sense of Corporate Social Responsibility, or CSR) are their mottos.

Securing and enhancing their offer to consumers is thus an essential component of their market longevity Check out our complete article dedicated to this topic here)3.

Another major challenge for these digital brands is approaching their future placing in pharmacies. Many of them share the significant goal of capitalising on their consumer communities and diversifying their distribution channels by targeting pharmacies, which account for more than 50% of food supplement sales in France.4

Support: a key to start-up success

These innovative young companies present great growth prospects but also have a high failure rate: 90% of them disappear before reaching their sixth anniversary. 5,6

However, more encouraging figures show that start-ups that seek support see their failure rates significantly reduced. 7,8 A survey conducted in a study among 106 French start-ups also reveals that 80% of them believe they need outside help (support and advisory structures, investors, other entrepreneurs, peers, mentors…) to think about or achieve their goals8 – whether it is to quickly establish themselves in a new market independently or accelerate their growth through strategic partnerships or new stakeholders taking an equity stake.

Expertise and vigilance at every stage

In the nutraceutical market, there are many pitfalls to avoid ensuring the launch of a new product or the emergence of a brand.

Formulation, choice and sourcing of ingredients, selection of industrial partners, regulatory validation and insurance, differentiation and enhancement of the product in its competitive environment…: each development stage requires specific expertise and raises points of vigilance.

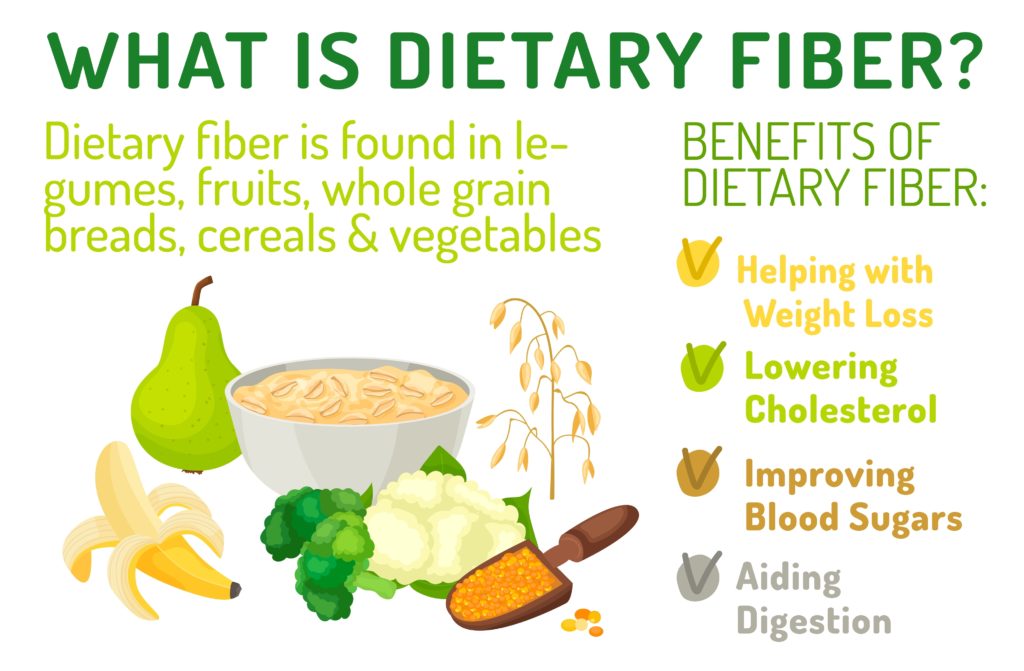

Starting with the quality and safety of the plant materials used. Today, 75% of food supplements on the French market contain at least one plant9. Given the increasingly frequent adulterations10 of plant-based ingredients, rigorous sourcing and precise analytical control are essential to ensure consumers receive effective and safe products (Check out our complete article dedicated to this topic here)3 .

Regulatory expertise also guarantees a product adapted to its target markets. The choice of ingredients, their dosage, their specifications are crucial elements for the scientific robustness of the formula but also for its regulatory compliance. Not to mention the management of health claims, a subtle lexical discipline that must highlight a product’s properties without exceeding the mentions authorised by the EFSA (European Food Safety Authority responsible for verifying the scientific validity of health claims).

The DGCCRF (Directorate-General for Competition Policy and Consumer Affairs) has conducted several investigations on online food supplement sales sites. In 2017, a control revealed a non-compliance rate of 76%, corresponding to inappropriate use of health claims (unauthorised health claims or used inconsistently) 11.

Finally, knowledge of a network of reliable industrial partners from all backgrounds (nutraceutical, pharmaceutical, and food) opens the door to innovation. Galenic forms are an essential way of standing out in the food supplement market. They help make the consumer experience unforgettable, promote adherence, and ultimately encourage repeat purchases. Another key success factor for a brand (Check out our complete article on galenic innovation (see our complete article here) 2

To you, food supplement start-ups: we offer tailored support with a “Special Start-up Offer”!

Our team of nutraceutical experts and our network of industrial partners are ready to support your project’s success.

Whether you have already launched or are about to start, we strengthen your in-house expertise and guide you in your strategic decisions at every stage of your development: from the conception to the marketing of the finished product. We will be by your side to strengthen and enhance your market position, helping you generate new growth opportunities. Join us and turn your ideas into concrete successes!

References:

- 2022 panorama of French DNVB – the growth of DNVB is confirmed (DNG) https://www.digitalnativegroup.com/blog-posts/panorama-2022-des-dnvb-francaises

- Article: Galenic innovation: the importance of combining effectiveness and pleasure in food supplements – BOTANI BRANDS blog https://www.botanibrands.com/en/galenic-innovation-effectiveness-pleasure-food-supplements/

- Article: Plant-based dietary supplements: how can a brand secure and enhance its offering? – BOTANI BRANDS blog https://www.botanibrands.com/en/plant-based-dietary-supplements-how-can-a-brand-secure-and-enhance-its-offering/

- The dietary supplement market – 2023 figures from Synadiet https://www.synadiet.org/leur-consommation/

- Success of start-ups: a case study based on an integrative and multidimensional approach – Ben Romdhane, Emna

- Dangerous k. Marsal J.M. Mazars-Chapelon a. Villesèque-Dubus f. (2018). Management control and start-ups: a reflection on the nature and roles of management control tools.

- Entrepreneurship – Facts and figures by DGE (General Directorate for Enterprises) https://www.entreprises.gouv.fr/files/files/directions_services/politique-et-enjeux/entrepreneuriat/entrepreneuriat-faits-et-chiffres.pdf

- What is a successful start-up? The success of start-ups beyond financial valuation – BGG and la Boussole https://www.laboussole.io/etudes-laboussolexbcg

- Synadiet https://www.synadiet.org/leur-consommation/

- Definition of adulteration of plant-based ingredients: any practice aimed at deliberately altering, modifying, or contaminating plant-derived products to deceive consumers or gain an illegitimate economic advantage.

- Control of nutritional and health claims on dietary supplement websites – DGCCRF https://www.economie.gouv.fr/dgccrf/controle-des-allegations-nutritionnelles-et-de-sante-sur-les-sites-internet-de-complements